VR/AR in banking and fintech

Unleashing the Power of AI in Banking and Fintech

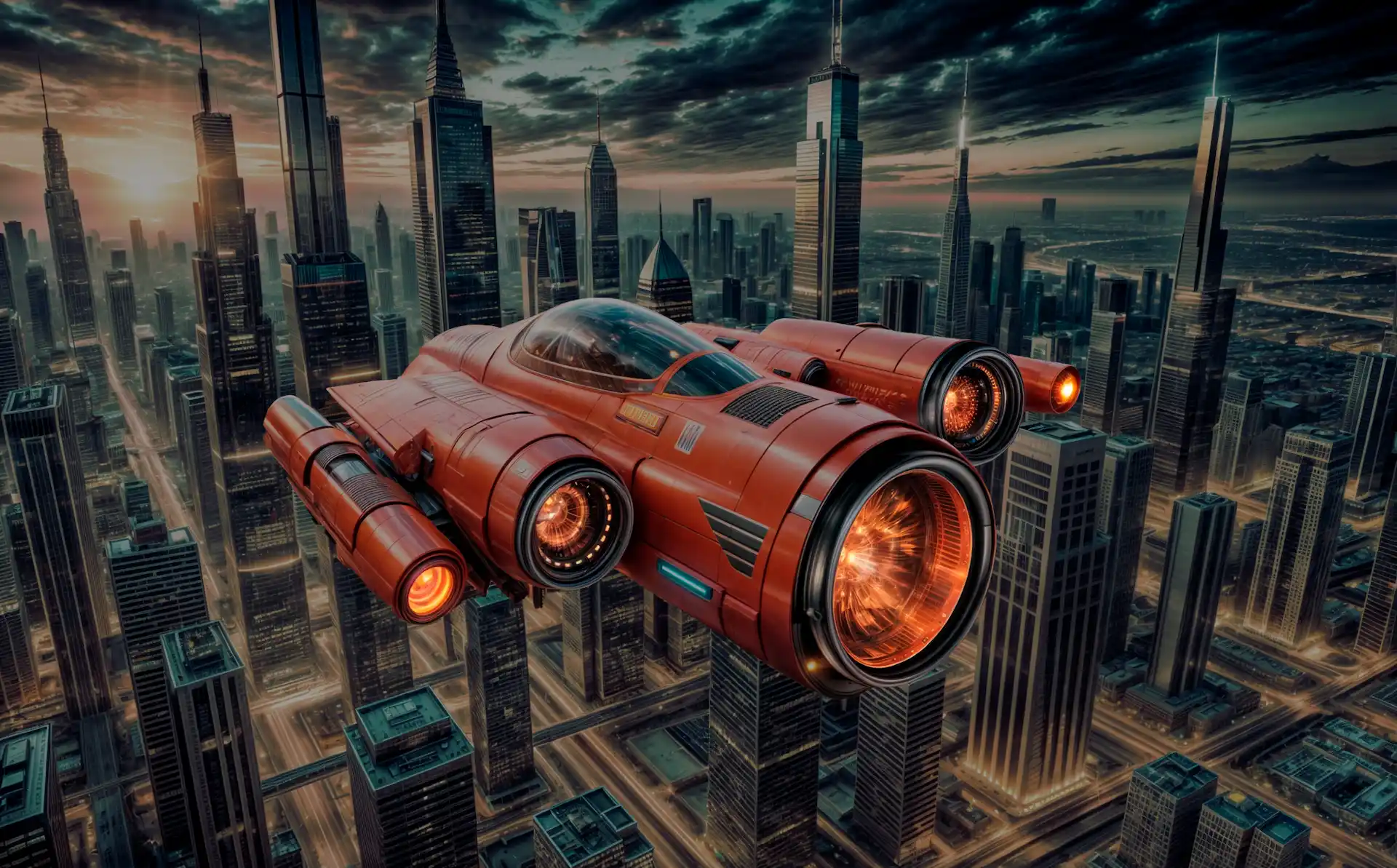

In the dynamic realm of banking and fintech, the infusion of AI stands as a transformative force, seamlessly amalgamating programming prowess, logical acumen, mathematical finesse, and statistical insight. Imagine this: you step into a banking institution and are greeted by an AI-powered avatar, an astute guide addressing your queries. But there's more to this futuristic scenario - you're not confined to your physical space; everything unfolds within the realm of mixed reality. This leap towards innovation also means bidding farewell to the human element and the accompanying overhead costs.

In essence, AI opens up a realm of opportunities for the banking and fintech sector, encompassing:

- Enhanced Security: The prowess of AI, bolstered by its subdomains, becomes a stalwart defender against cyber malefactors, fraudsters, unauthorized breaches, and insidious malware.

- Tailored, Exceptional User Experiences: Enter AI-powered chatbots , tirelessly available to cater to customer queries 24/7, ushering in a new era of personalized and seamless support.

- Efficiency Overhaul for Time and Resources: AI's remarkable automation capabilities unshackle the burden of mundane daily operations, leading to a reduced dependency on human intervention. The outcome? Fewer human resources and substantial savings of both time and money.

- Mitigation of Risks and Predicaments: AI steps in not just with precise risk evaluations, but also with intelligent predictions, offering a more intelligent technology approach to tackling challenges.

Embracing these facets of advancement, ServReality stands ready to craft the next generation of smart banking and fintech applications. Your journey toward the future starts here.