How powerful Oculus Quest 2 (comparison with the Quest, Go, the PC and consoles)

How powerful Oculus Quest 2 (comparison with the Quest, Go, the PC and consoles)

Oculus Quest 2 unquestionably, the most popular thing in VR at the moment - and the most powerful standalone VR headset. But is it powerful? Can you compare it with consoles or PC?

Gaming PCs and consoles consume almost unlimited amounts of electricity and usually have a powerful cooling system. They consume hundreds of watts to achieve maximum performance.

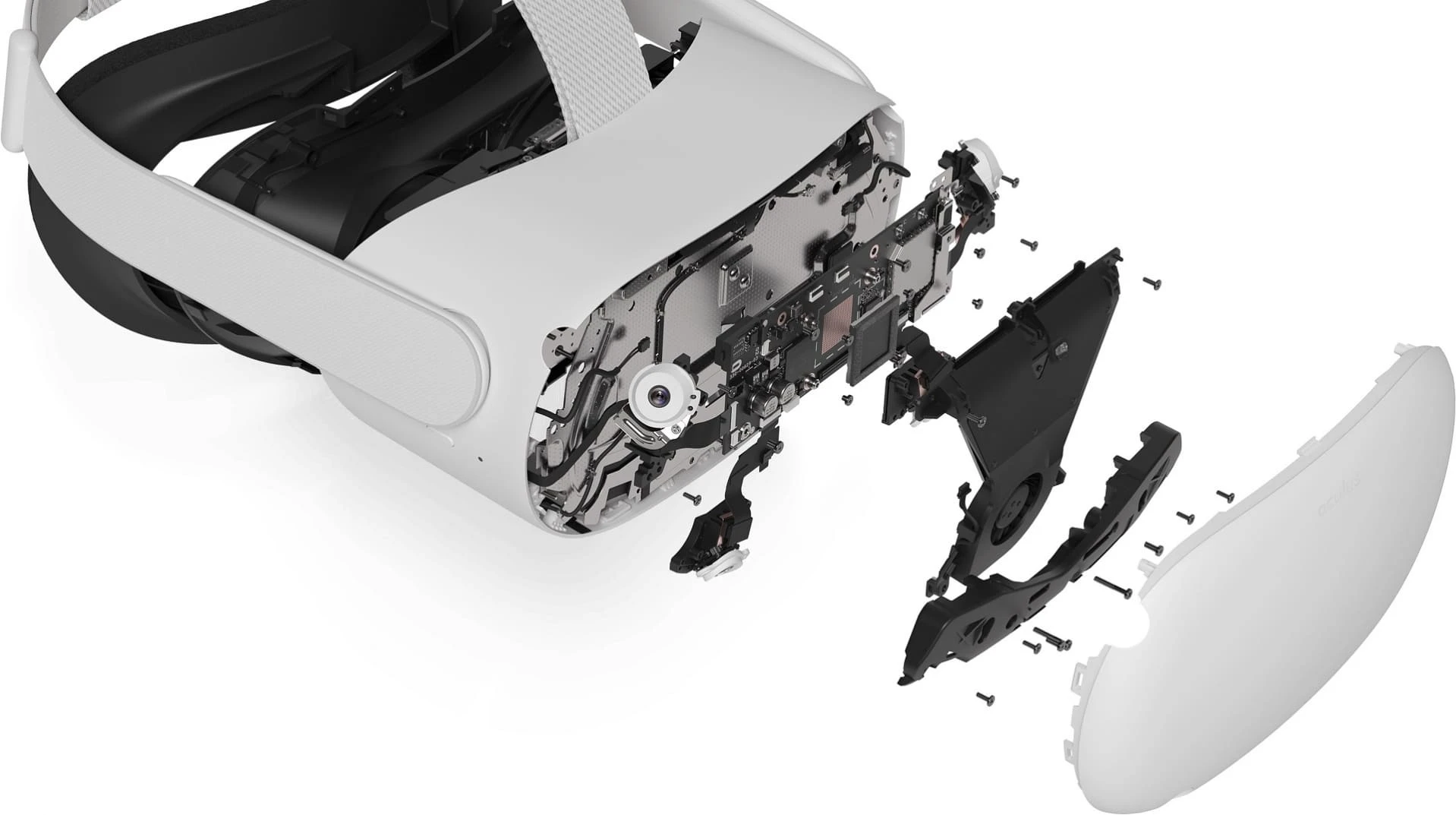

Quest 2 uses chipset Qualcomm Snapdragon XR2, which is a variant of the Snapdragon chip 865 is used in high performance smartphones, such as Samsung Galaxy S20 Ultra.

Mobile chips are supposed to efficiently use the on-Board battery, and cooling system places much less. They are designed for efficiency and performance, usually consuming only about 5 watts.

Despite these limitations, growing investment in research and development of mobile chips for the last decade, caused a huge industry of smartphones and tablets, mean that Snapdragon XR2 from Quest 2 is surprisingly well kept.

Processor

CPU (Central processor) is a common computational component. It executes the code and sends instructions for rendering on the GPU. In games the CPU usage is mostly related to calculations of physics and AI.

| Headset | The process node | "Golden" kernel | "Silver" kernel | Cache |

| Oculus Go | 14 nm | 2x 2.3 GHz | 2x 1.6 GHz | 2 MB L2 |

| Oculus Quest | 10 nm | 3x 2.3 GHz | 4x 1.9 GHz | 3 MB L2 |

| Oculus Quest 2 | 7 nm | 3x 1.5 GHz | 4x 1.9 GHz | 1.8 MB L2 + 4 MB L3 |

Quest 2 processor has a clock speed much lower than what it is theoretically capable of. He also has a new "main "core, but clocked even lower.

Processors in mobile chips such as Qualcomm, actually use the instruction set architecture (ISA) than that of Intel and AMD processors used in PCs. Mobile chips use ARM, chips PC - x86. This means that a direct comparison it is difficult to conduct.

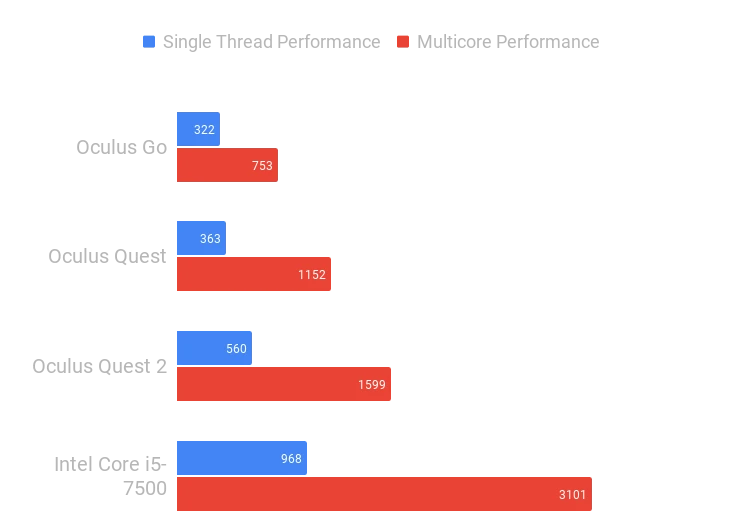

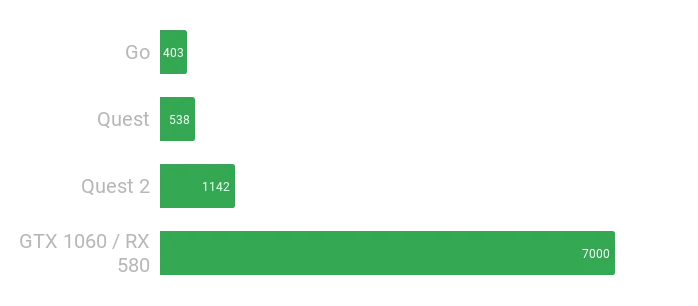

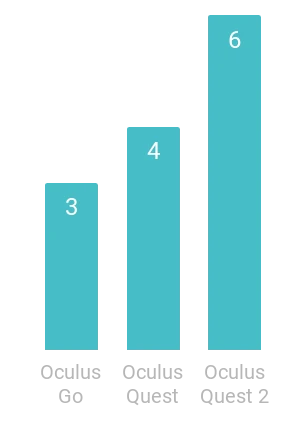

However, the GeekBench testing tool 5 specifically designed for such comparisons between architectures. UploadVR downloaded the tool to Go, Quest 1 and Quest 2, adding in a comparison of Intel mentioned on the store page Half-Life: Alyx Steam:

To test as accurately as possible, they used ADB commands to use the maximum available clock frequency of the processor (level 4) and cut off the Guardian.

Processor Quest 2 is slightly superior to its predecessors, but lower clock frequency means that the difference is not as great as one would assume after three generations.

GPU

The GPU is responsible for rendering images and other graphic tasks. The GPU is the main component video/graphic card, so these terms are often used interchangeably.

| Headset | GPU | The process node | ALU | GFLOPS |

| Oculus Go | Adreno 530 | 14 nm | 256 | ~ 450 |

| Oculus Quest | Adreno 540 | 10 nm | 384 | ~ 560 |

| Oculus Quest 2 | Adreno 650 | 7 nm | 1024 | ~ 1250 |

Only one specification shows that the GPU Quest 2 is a significant upgrade - much more than the same processor. In fact, it is the first standalone virtual reality headset, which crossed the mark of 1 teraflops, which made it possible to achieve the same performance as the original Xbox One.

Or in other words, the GPU Oculus Quest 2 (at least on paper) twice as powerful than the Nintendo Switch, although both have a cost of $ 299.

However, the Switch can render at 720p at 30 frames per second while maintaining acceptable image quality. The rendering resolution Quest 2 by default two times the number of pixels on the eyes, and the minimum FPS for games is 72.

But does this performance in actual use? For testing GPUs on different platforms UploadVR used GFXBench Aztec Ruins. As for processors, GeekBench, GFXBench tailored to architectural differences.

The results show that the GPU Quest 2 really is a huge upgrade. The system operates with higher default resolution than Quest 1, and may support mode 90 Hz with an increase of 25% fps. However, some VR developers have gone further, adding new textures, shaders, and effects for owners of Quest 2.

However, compared to the graphics cards listed on the store page Half-Life: Alyx on Steam, the graphics capabilities Quest 2 is much less impressive:

Autonomous virtual reality is making huge advances in the field of graphics processing, but there is still a long way to go to match hardware requirements: PC at least five years ago.

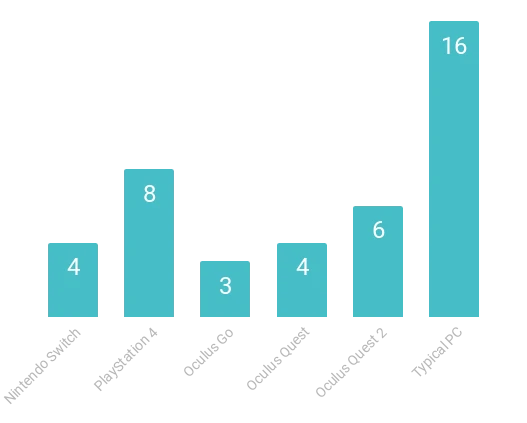

RAM

RAM (memory) is the place where the computer temporarily stores the assets and data that is used at the moment. It is much faster than primary storage.

More RAM allows the use of larger environment and reduces the load or hitches when moving between areas - although it is also associated with velocity storage.

6 GB RAM Quest 2 may be a key to open the worlds AAA-level in the future.

Keep in mind that in all systems part of the memory occupied by the operating system and background processes. And graphic processors for PCs also have gigabytes even faster video memory (VRAM - eng. Video Random Access Memory - RAM for video) to work.