AI in banking and fintech

There are numerous ways banking and Fintech companies can benefit from AI because it smoothly and efficiently combines the programming, logical reasoning, mathematics and statistics. Picture this: you go to the banking institution and come across the AI-powered avatar that guides you and answers all your questions. That's not all: you don't need to leave you real place, everything takes place in the mixed reality. And thus, the human element along with all associated expenses is being removed.

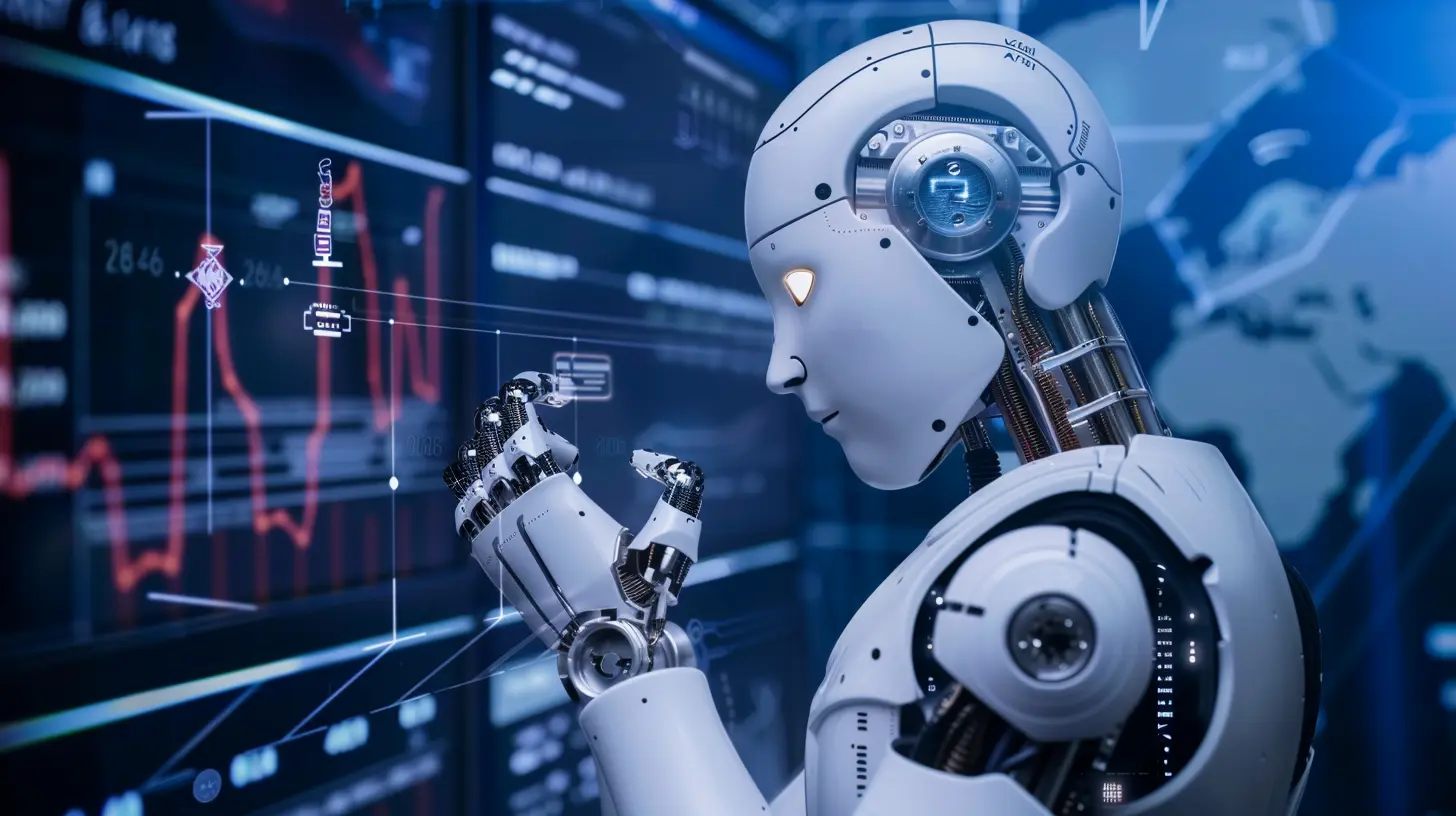

In short, for banking and fintech, AI offers the following opportunities:

- Improved security: AI and its subfields can protect from cyber criminals, fraud, unauthorized access, and malware.

- Greater, more personalized user experiences: AI-powered chatbots provide round-the-clock support for customers.

- Solid time and money reduction: AI can automate numerous daily operations, reducing the number of people needed. And thus, fewer human resources, greater time and money savings.

- Risk and problems elimination: AI offers not only accurate risk analysis, but also smart predictions, and more intelligent technology.

ServReality can create those smart banking and fintech apps for you.